International wheat prices have risen significantly

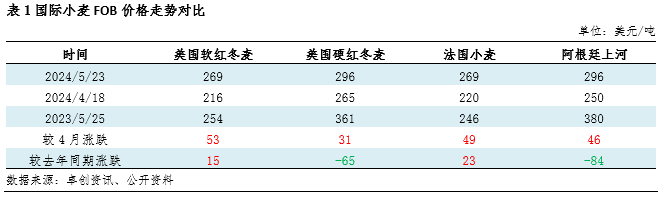

Since late April, international wheat prices have fluctuated upwards, changing the previous weak situation. Taking the price of soft red winter wheat in the United States as an example, as of May 23, the FOB spot price of soft red winter wheat in the United States was $269/ton, an increase of $53/ton from the price of the week on April 18, an increase of 24.54%, and also higher than the price level of the same period last year.

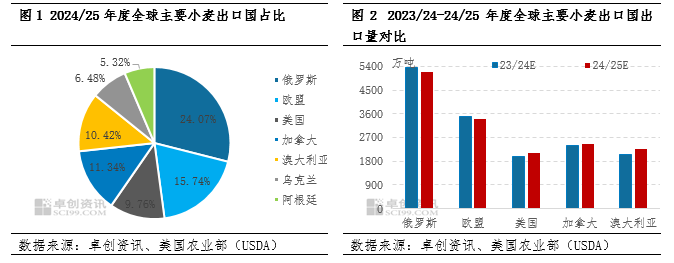

The main reason for this rise is that adverse weather conditions in some European wheat producing countries and regions, such as Russia, have raised concerns about global wheat supply for the new year. Most areas of the Black Sea continue to experience cold wave weather, which may cause some localized frost damage to newly emerged summer crops. The dry weather in the central region has also intensified, so most institutions have lowered their wheat production and export data for the new year. Due to Russia, the European Union, and other major suppliers and exporters of wheat, Russia is the world’s largest exporter of wheat, accounting for 24.07%, followed by the European Union, accounting for 15.74%. According to the latest USDA report’s forecast data, the export volume of new wheat from Russia and the EU region has been reduced to varying degrees, which may affect the global wheat supply and goods flow in the new year.

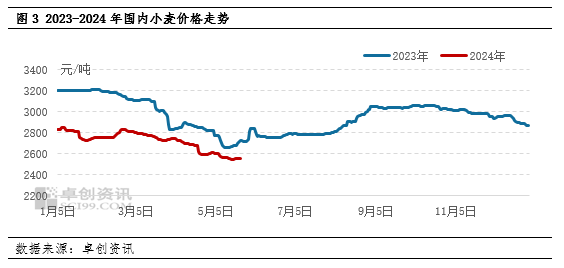

Domestic wheat in the stage of new and old alternation, with low prices running after a downward trend

Since late April, the domestic wheat market has continued to show a volatile downward trend. As of May 24th, the national average wheat price according to Zhuochuang Information was 2553.5 yuan/ton, a month on month decrease of 41.95 yuan/ton, a decrease of 1.62%. The main reason is that the increase in demand for flour is limited, and downstream customers maintain rigid procurement, resulting in slow delivery by flour manufacturers. At the same time, considering the upcoming launch of new wheat, some grain hoarding traders continue to sell their wheat inventory, while flour mills have low purchasing enthusiasm due to low processing volume, resulting in a slight downward trend in wheat prices as a whole. However, since May, the rotation of wheat has been gradually stopped, and in some areas where new wheat is listed early, the purchase prices of reserve warehouses have also been released or purchased in a timely manner, which to some extent provides support for wheat prices. Therefore, wheat prices have been relatively stable at a low level recently.

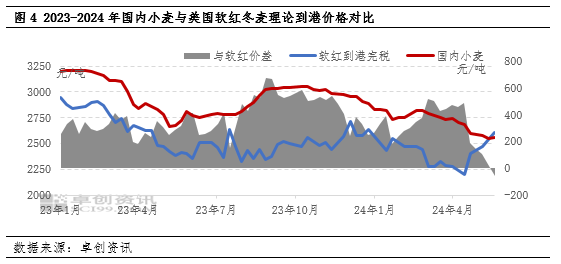

The inverted price difference between domestic and international wheat prices may slightly drive domestic wheat prices

Under the differentiation trend of rising international wheat prices and slight decline in domestic wheat prices, the price difference between domestic and international wheat has gradually narrowed, and even inverted. Comparing the FOB price of US soft red winter wheat with the domestic wheat price, it can be seen that before mid April, the price difference between domestic and foreign wheat was between 200-400 yuan/ton, and in some time periods, the price difference could reach over 600 yuan/ton. The price advantage of imported wheat is more obvious. Starting from late April, the price difference between domestic and foreign wheat has rapidly shrunk. As of May 23, the theoretical price difference between domestic and foreign wheat was -55.75 yuan/ton. In addition, the theoretical cost of loading and unloading fees and shipping to downstream domestic enterprises has far exceeded the domestic wheat price, and imported wheat no longer has a price advantage.

Overall, with the inverted price difference between domestic and foreign wheat, the demand for imported wheat may decrease, leading to a return of some demand to the domestic market. So in the early stages of the new wheat market, some market entities may have increased demand for bargain hunting procurement, and there is a possibility of a slight increase in domestic wheat prices at a low level.

Source: Xinhua Finance and Economics(https://www.cnfin.com/dz-lb/detail/20240528/4054147_1.html)